Hi there, it’s Janice. I started this newsletter to provide a straightforward, guided approach to understanding and managing the complex dispute process. That includes disputes from the issuing bank, acquiring bank and merchant's perspectives. Subscribe and never miss an issue. Questions you’d like to see me answer?

Online payments is undergoing a significant transformation, with the introduction of Click to Pay promising to streamline e-commerce transactions. This new standard aims to bring the convenience of contactless in-store payments to the online shopping experience.

The Rise of Contactless Payments

Recent years have seen a marked shift towards contactless payments in physical stores, driven by convenience and, more recently, hygiene concerns during the COVID-19 pandemic. According to the Mastercard New Payments Index, 44% of consumers have made a contactless card payment in the past year instead of inserting or swiping, with half of them reporting increased usage. Contactless transactions surged by 40% worldwide in early 2020 as the pandemic spread.

The Need for Online Payment Evolution

While in-store payment methods have evolved, online shopping has not kept pace with these advancements. The same Mastercard survey reveals that 64% of respondents say they are likely to make an online payment via manual entry of card details over the next year, highlighting the need for a more streamlined solution.

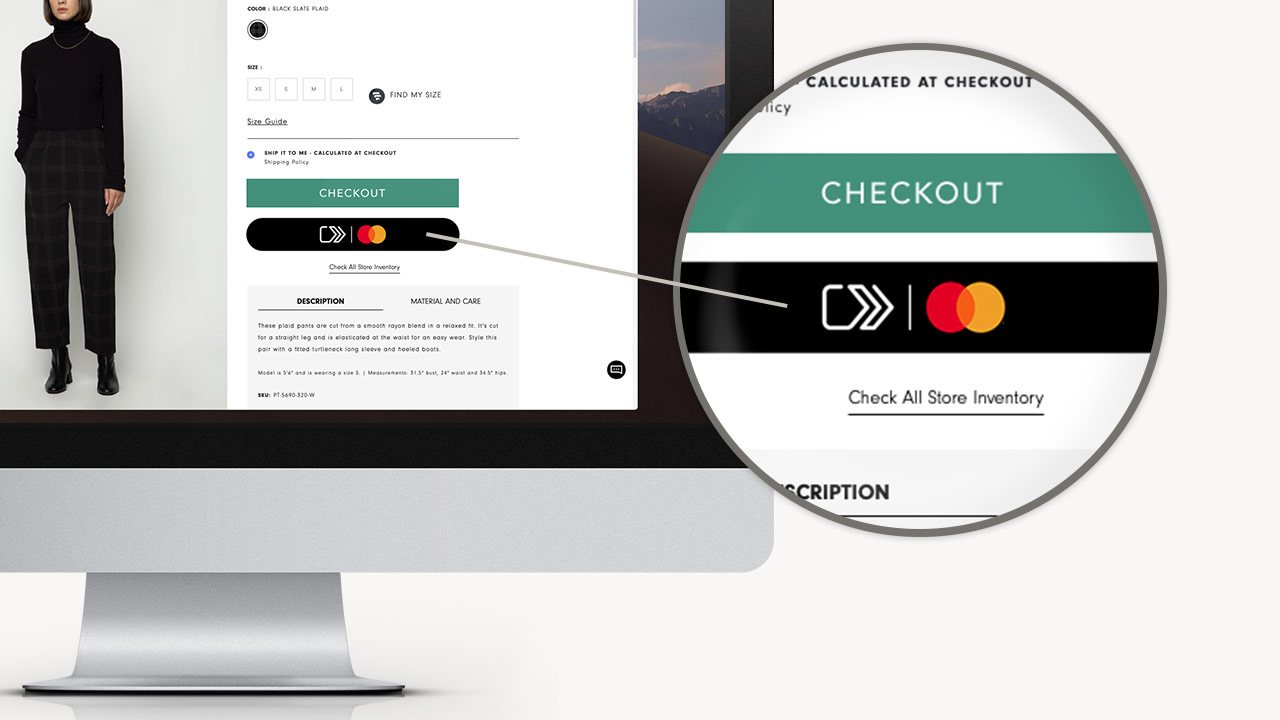

Introducing Click to Pay

Click to Pay is a new checkout standard backed by major card networks. It's designed to simplify online transactions, making them as effortless as tapping a card in a store.

The core concept is straightforward: users enter their card details once, after which they can use them across any website supporting Click to Pay.

Key Features and Benefits

Security: Click to Pay addresses a critical concern in online shopping: security. It employs advanced tokenization technology, replacing actual card numbers with unique codes, thus enhancing protection against fraud. This is particularly important given that 70% of consumers agree or strongly agree that they are concerned about their saved card details being compromised.

Universality: Unlike retailer-specific saved card details, Click to Pay functions across multiple merchants.

Consistency: It offers a uniform checkout experience across various online retailers.

Efficiency: Fewer steps in the checkout process can lead to reduced cart abandonment rates.

Complementing Existing Solutions

Click to Pay is not intended to replace existing payment methods such as digital wallets or retailer-specific saved cards (CoF - card on file).

Instead, it's designed to complement these options, providing a secure, standardized alternative, particularly useful for transactions on new or infrequently visited websites.

Stakeholder Benefits

Banks (Issuers):

Helps maintain relevance in the digital age

Keeps their cards at the forefront of consumers' payment options

Allows for "push" provisioning of tokenized card details

Payment Service Providers (PSPs):

Offers an opportunity to enhance their services, particularly for smaller retailers

Provides a recognized brand for PSPs that aren't household names

Retailers:

Potentially reduces cart abandonment rates

Improves customer experience

Offers device recognition technology to cater to returning customers' needs

Implementation and Adoption

The rollout of Click to Pay is already underway, though widespread adoption will take time as banks, payment processors, and online retailers integrate the system. However, given the benefits it offers to all parties involved, rapid adoption is likely.

As Click to Pay gains traction, we can anticipate further developments in the online payment sphere. Future iterations may incorporate features such as:

Installment payments

Reward point redemption

Cryptocurrency transactions

Click to Pay represents a significant step forward in the evolution of online payments. While the transition won't happen overnight, it's poised to become increasingly prevalent in the e-commerce landscape over the coming years. This development signifies more than just a new payment option; it represents a shift towards a more seamless, secure, and standardized online shopping experience.

If you need help in managing your chargebacks, or simply need advice:

I offer a range of services to help businesses effectively manage payment disputes and protect their revenue:

Chargeback Management: Comprehensive strategies to minimize the impact of chargebacks, including prevention techniques, representment, pre-arbitration and arbitration guidance, and dispute resolution best practices.

Risk Assessment: Thorough assessments of your current payment processing practices, identifying vulnerabilities and providing actionable recommendations.

Data-Driven Insights: My recommendations are based on thorough analysis of your business data, industry trends, and best practices, enabling confident decision-making.

Training and Education: Customized training programs to empower your team with the knowledge and skills to handle payment disputes effectively, as an issuer, acquirer, payment processor or merchant.

Strategic Consulting: Tailored strategies that align with your unique business goals, ensuring long-term success in the face of evolving chargeback challenges.