Streamlined Guide to the Chargeback Process and Timelines

A complex process simplified and demystified.

Need Help in Managing Your Chargebacks?

Or simply need advice:

I offer a range of services to help businesses effectively manage payment disputes and protect their revenue:

Chargeback Management: Comprehensive strategies to minimize the impact of chargebacks, including prevention techniques, representment, pre-arbitration and arbitration guidance, and dispute resolution best practices.

Risk Assessment: Thorough assessments of your current payment processing practices, identifying vulnerabilities and providing actionable recommendations.

Data-Driven Insights: My recommendations are based on thorough analysis of your business data, industry trends, and best practices, enabling confident decision-making.

Training and Education: Customized training programs to empower your team with the knowledge and skills to handle payment disputes effectively, as an issuer, acquirer, payment processor or merchant.

Strategic Consulting: Tailored strategies that align with your unique business goals, ensuring long-term success in the face of evolving chargeback challenges.

Chargeback Process

Stage 1

The cardholder initiates the process:

The cardholder files a dispute with their issuing bank within 120 days of the transaction.

The issuing bank reviews the dispute and, if deemed valid, initiates a chargeback with the merchant's acquiring bank.

The issuing bank temporarily credits the disputed funds to the cardholder’s account.

Stage 2

The merchant receives the chargeback:

The acquiring bank notifies the merchant of the chargeback, and the disputed funds are temporarily removed from the merchant's account.

The merchant has the option to accept the chargeback or contest it by providing evidence to support the transaction's validity within a specified timeframe (usually 7-10 days).

If contested, the acquiring bank reviews the evidence and determines whether to submit it to the issuing bank.

If accepted, the process stops here and the funds are permanently debited rom the merchant and credited to the cardholder. The rest of the process no longer applies of the merchant chooses to accept the chargeback.

Stage 3

The case is returned to the issuing bank:

The issuing bank reviews the evidence provided by the merchant through their acquiring bank.

The issuing bank then decides to either reverse the chargeback (in favor of the merchant) or uphold it (in favor of the cardholder).

Resolved in favor of the merchant:

the issuing bank can go back to the cardholder to request additional evidence (depending on the card network and the chargeback reason) in order to pursue the pre-arbitration stage. In such case, the process goes back to Step 1.

the issuing bank can decide to completely end the process at this stage and resolve in favor of the merchant, and rebill the cardholder.

Resolved in favor of the cardholder:

the issuing bank can decide to resolve in favor of the cardholder and end the process at this stage (depending on the card network and the chargeback reason).

The temporary credit to the cardholder and the debit to the merchant account become permanent.

Stage 4

When applicable, further arbitration may be pursued through the card network (e.g., Visa or Mastercard). Either the issuing bank or acquiring bank, depending on the card network and chargeback reason, can file arbitration.

Arbitration Process

Arbitration in the chargeback process is a final step that can be taken when the issuing bank and the acquiring bank cannot come to an agreement about the outcome of a chargeback. It is a procedure overseen by the card network to resolve the dispute between the two parties.

When a case is escalated to arbitration, the card network will review the case, considering the evidence provided by both the merchant and the cardholder, and make a final decision on the matter.

No additional evidence can be presented at the arbitration stage. The card networks will only consider evidence submitted in prior stages.

Arbitration is generally seen as a last resort, as it can be a time-consuming and expensive process for all parties involved. The party that loses the arbitration case will be responsible for paying the associated fees (usually around $500 to $750).

Timelines

The entire chargeback process can take anywhere from a few weeks to several months, depending on the complexity of the case and the actions taken by the involved parties.

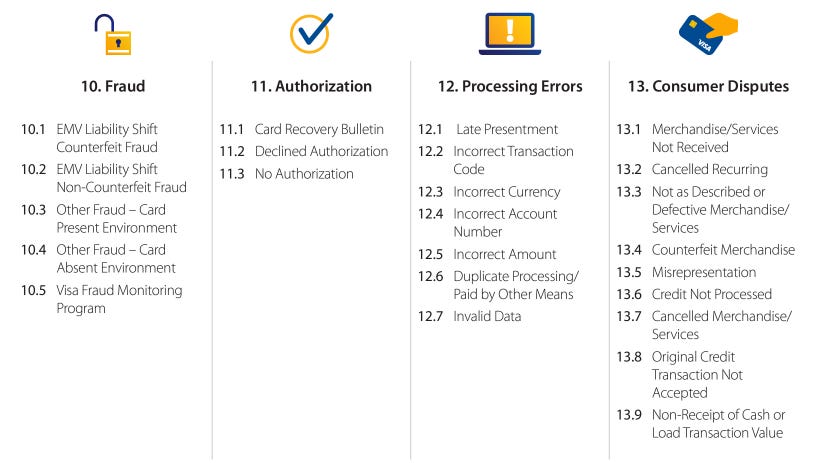

Visa

The timeline for Visa chargebacks is dependent on the dispute type outlined below.

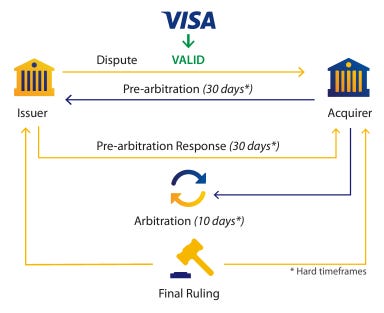

Fraud and Authorization Disputes (Allocation)

Dispute: The issuer initiates a dispute on behalf of the cardholder. Visa validates the dispute to ensure it meets the necessary criteria.

Pre-arbitration (30 days*): The acquirer can either accept the dispute or fight it by providing evidence to support their case. The acquirer has up to 30 days to respond to the dispute.

Pre-arbitration Response (30 days*): The issuer can do either of these things:

accept the pre-arbitration request, in which case ruling in favor of the merchant

reject the pre-arbitration request, in which case ruling in favor of the cardholder

continue with the case by providing additional evidence to support their case within 30 days (uncommon)

Arbitration (10 days*): If the acquirer receives a pre-arbitration response but continues to disagree with the issuer's response, the acquirer has 10 days to escalate the case to arbitration to Visa.

Final Ruling: Visa reviews the case during the arbitration stage and provides a final ruling.

The losing party will be liable for arbitration fees.

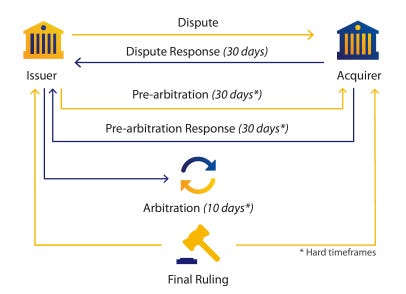

Consumer and Processing Error Disputes (Collaboration)

Dispute: The issuer initiates a dispute on behalf of the cardholder and sends it to the acquirer.

Dispute Response (30 days*): The acquirer has up to 30 days to respond to the dispute by either accepting it or fighting it with evidence.

Pre-arbitration (30 days*): If the acquirer fights the dispute, the issuer reviews the evidence provided and decides whether to accept the dispute response or escalate the case to pre-arbitration. The issuer has 30 days to initiate pre-arbitration.

Pre-arbitration Response (30 days*): The acquirer has 30 days to respond to the pre-arbitration by either accepting it or fighting it with additional evidence.

Arbitration (10 days*): If the acquirer fights the pre-arbitration and the issuer does not agree with the acquirer's response, the issuer has 10 days to escalate the case to arbitration.

Final Ruling: During the arbitration stage, Visa reviews the case and provides a final ruling.

The losing party will be liable for arbitration fees.

Mastercard

First Chargeback (90, 120 or 540 Days* depending upon reason code and dispute): The issuer initiates a chargeback on behalf of the cardholder and sends it to the acquirer.

Second Presentment (45 Days): The acquirer has up to 45 days to respond to the first chargeback by either accepting it or fighting it with evidence.